Get It Done With M2M

Match hedges to physical inventory, analyze hedging impact on cost and pricing, and manage risk.

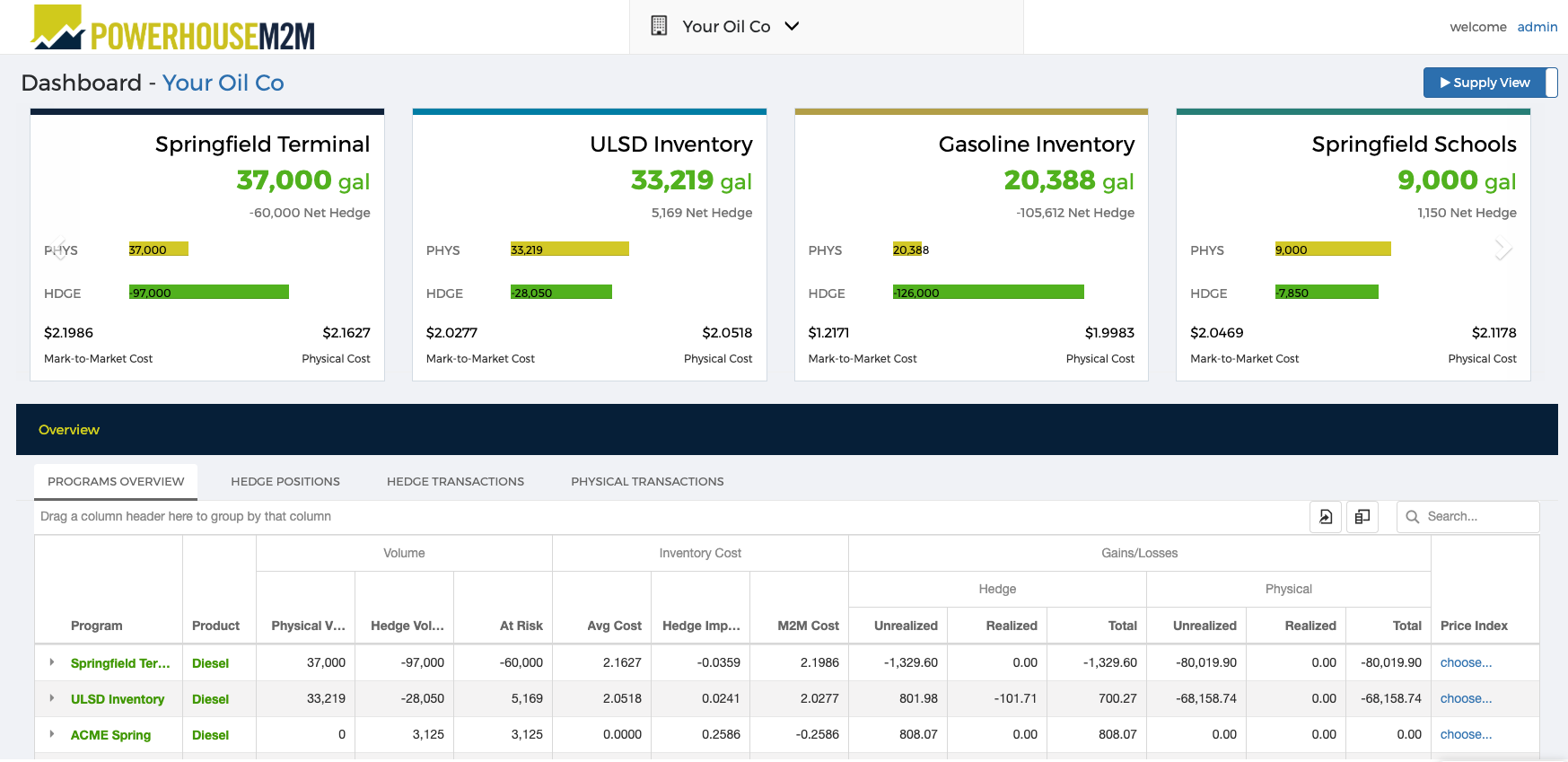

Monitor Risk

Monitor price risk at company and hedge program levels.

Fuel Costs

Monitor physical cost of fuel in inventory, and the marked-to-market cost of fuel after applying the impact of hedging.

Log Transactions

M2M can be used to track, log, and manage physical and hedge transactions. Use the trade logs to maintain history, and assign transactions to specific hedge programs.

Balance Hedges

Ensure that physical volume is matched with appropriate hedges. Assign all or part of hedge contracts to one or more programs.

Automate Data Entry

Hedge transactions can be automatically pulled from your broker. Futures market prices are updated nightly.

Sharing

Allow accounting, supply, and management to share a single, consistent view of your company hedging program’s trades, positions, volumes, and costs.

Analyze Financial Data

M2M tracks inventory cost and hedge data by program/terminal and/or product to provide a combined, “marked-to-market” view of the physical cost of inventory and the impact on hedging.

Increase Confidence in Decision Making

Know that your hedging operation is balanced (volume-matched) with your physical inventory. Get a view of your risk exposure at a company and hedge program level. Make daily supply decisions based on an up-to-date understanding of the marked-to-market cost of your inventory (including the impact of your hedging operations).

Want More Information

Give us your email address, and we will reach out to schedule a demo.

Managing Your Business Doesn’t Have to Be Hard

Forget about maintaining increasingly complex spreadsheets. Stop using multiple brokerage accounts to keep your hedge programs straight.

Focus on the information you need to make decisions about your business.

Want to Learn More?

Call (202) 333-5380

email: info@powerhousetl.com